Adobe just posted $5.99 billion in quarterly revenue. Record-breaking numbers. Yet Morgan Stanley downgraded the company’s stock rating anyway.

What’s happening? Wall Street analysts think Adobe isn’t moving fast enough in the AI race. Meanwhile, Adobe is quietly reshaping its entire AI strategy by bringing third-party models into Creative Cloud for the first time.

The tension between creative software excellence and investor expectations could fundamentally change how millions of photographers and designers work.

Wall Street Wants Faster AI Growth

Morgan Stanley analyst Keith Weiss dropped Adobe from “overweight” to “equal weight” in recent stock recommendations. Translation? Analysts expect Adobe’s stock to perform just average compared to the market.

The reasoning? Adobe’s Digital Media division shows “directionality diverging from the pace and quality of innovation.” That’s analyst-speak for “your AI isn’t growing fast enough.”

But here’s what makes this bizarre. Adobe posted 11 percent year-over-year revenue growth in its third quarter. That’s $5.99 billion in three months. Plus, the company exceeded its original 2025 predictions and raised year-end targets.

So why the downgrade? Analysts are comparing Adobe to companies like Google, which posted 32 percent growth in its cloud and AI division during the same period.

The Numbers Tell a Complex Story

Adobe’s Firefly AI gained “millions of downloads” on mobile. Monthly active users jumped 30 percent from the previous quarter. Those aren’t small numbers.

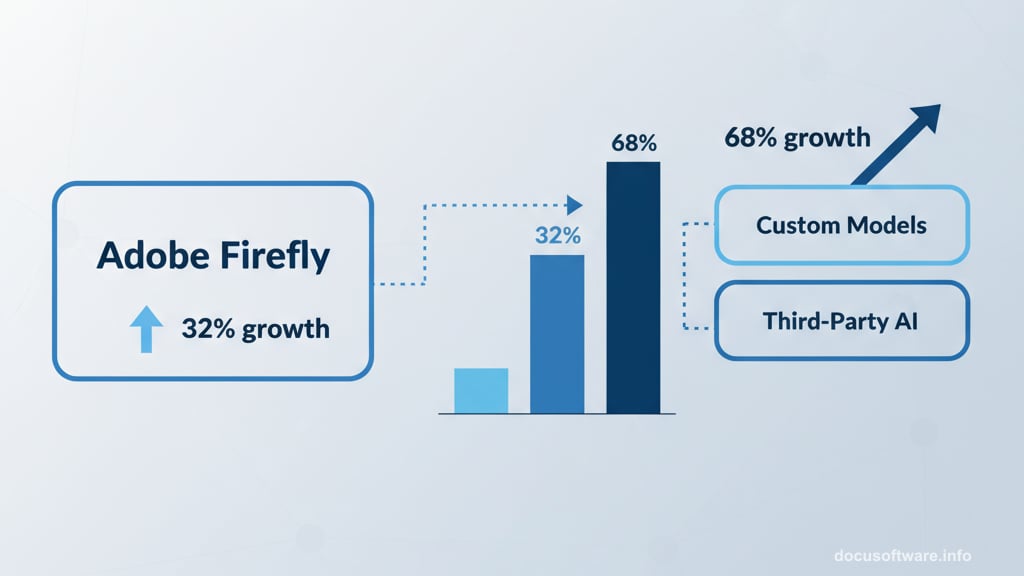

Yet something interesting emerged in Adobe’s financial reports. Third-party AI models inside Firefly are growing faster than Firefly itself. Custom models showed 68 percent quarter-over-quarter growth. Meanwhile, Firefly itself grew at 32 percent.

That gap matters. It suggests users want more AI options than Adobe’s homegrown Firefly provides. Adobe apparently noticed this trend too.

Adobe’s Response: Open the Gates

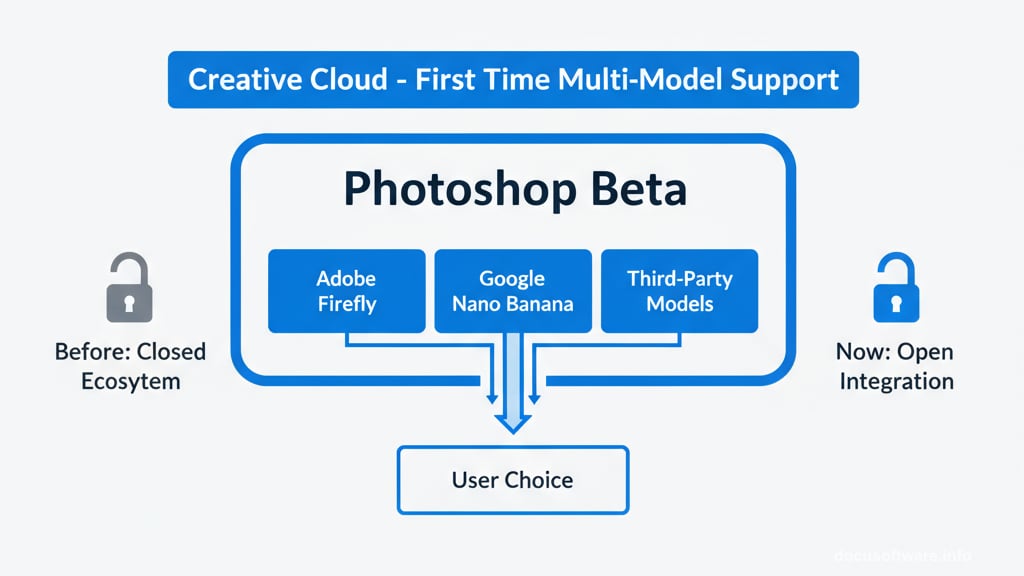

Adobe just made a surprising move. The beta version of Photoshop now lets users choose AI models besides Firefly. Third-party options like Google’s Nano Banana sit right alongside Adobe’s own algorithms.

This marks the first time Creative Cloud apps support non-Adobe AI models. Previously, Adobe kept its ecosystem closed. Only the standalone Firefly app offered third-party choices, starting in April.

Why the change? Adobe likely realized it can’t compete with every specialized AI model. Nano Banana excels at generating images of specific people. Other models handle different tasks better than Firefly. So instead of trying to beat everyone, Adobe decided to integrate everyone.

The strategy makes sense for a company serving diverse creative professionals. Photographers need different AI tools than graphic designers. Video editors have different requirements than illustrators. Supporting multiple models lets Adobe serve all these groups without building specialized AI for each.

The Training Data Advantage

Adobe built Firefly exclusively on licensed Adobe Stock content and public domain materials. That means content generated with Firefly carries commercial usage rights. No copyright concerns. No lawsuit risks.

This differentiates Adobe from competitors who scraped the internet to train their models. Companies like Stability AI and Midjourney face ongoing copyright lawsuits. OpenAI continues fighting claims from authors and artists.

For commercial photographers and designers, that distinction matters enormously. Using AI-generated content in client work without commercial guarantees creates legal exposure. Adobe’s licensing approach eliminates that risk.

But maintaining that ethical training approach costs money. Licensing content costs more than scraping websites. So Firefly’s development likely moves slower than competitors willing to cut corners.

What This Means for Creators

Adobe now walks a tightrope. Wall Street wants aggressive AI growth. Meanwhile, creative professionals want ethically trained models and professional-grade tools.

The third-party AI integration appears to be Adobe’s compromise. Keep Firefly’s commercially safe approach while offering access to more powerful models for those willing to accept different usage terms.

However, these premium AI features require more than just a Photoshop subscription. Users need a Firefly subscription or the All Apps plan after the initial trial period. That’s another subscription cost on top of existing Creative Cloud fees.

Creators already frustrated with Adobe’s subscription model and cancellation policies might resent additional AI subscription tiers. Yet Adobe needs to monetize its AI investments to satisfy Wall Street.

The Bigger Picture Nobody Discusses

Earlier this year, President Trump claimed paying copyright owners for training data is “not doable” if the US wants to remain competitive in AI. That statement put companies like Adobe in an uncomfortable position.

Adobe could abandon its ethical training approach. Switch to scraped data like competitors. That would speed up Firefish development and potentially satisfy Wall Street analysts demanding faster growth.

But it would also alienate the creative professionals who trust Adobe with their commercial work. Photographers don’t want to explain copyright lawsuits to clients. Designers need certainty about usage rights.

So Adobe’s strategy of offering both Firefly and third-party models might be brilliant. It gives users choices while maintaining Adobe’s ethical position. Users who need commercial safety stick with Firefly. Those who want cutting-edge capabilities can use other models with appropriate disclaimers.

Why 11 Percent Growth Isn’t Bad

As a photographer and Photoshop user, I don’t find 11 percent annual growth concerning. That’s healthy expansion in a mature software market.

Yet stock market pressure creates perverse incentives. Companies get punished for “only” growing 11 percent when competitors show 30 percent growth. So management faces pressure to chase higher numbers regardless of business fundamentals.

Adobe could respond to this pressure in destructive ways. Raise subscription prices. Cut corners on AI training data. Push aggressive upsells. All of these hurt users while potentially boosting short-term metrics.

Alternatively, Adobe could stay focused on what actually matters: building professional tools that serve creative workflows. The third-party AI integration suggests Adobe is choosing the latter path, at least for now.

What Comes Next

Adobe’s beta Photoshop update shows the company’s direction. Mix Firefly’s commercially safe approach with powerful third-party models. Let users choose the right tool for each task. Maintain Adobe’s traditional strengths in masking, layers, and precise control.

This beats generating images inside chatbots or consumer apps like Google Photos. Professional photographers need more control than generic AI interfaces provide. Adobe seems to understand that.

But the subscription pricing remains a concern. Adding Firefly subscriptions on top of Creative Cloud fees tests users’ patience. Adobe needs to prove the AI capabilities justify the additional cost.

Meanwhile, Wall Street will keep pressuring Adobe to show faster AI growth. Whether Adobe resists that pressure or compromises its values remains to be seen. For now, the company appears committed to balancing investor demands with creator needs.

That balance won’t satisfy everyone. But it might be the best approach in an industry where creative professionals and stock market analysts want fundamentally different things.