Adobe surprised investors Thursday with earnings that blew past expectations. The stock surged in after-hours trading, finally giving shareholders something to celebrate after a brutal year.

The design software giant reported $5.99 billion in revenue for its fiscal third quarter, beating analyst estimates of $5.91 billion. Plus, adjusted earnings hit $5.31 per share against expectations of $5.18. That’s the kind of beat that makes investors sit up and pay attention.

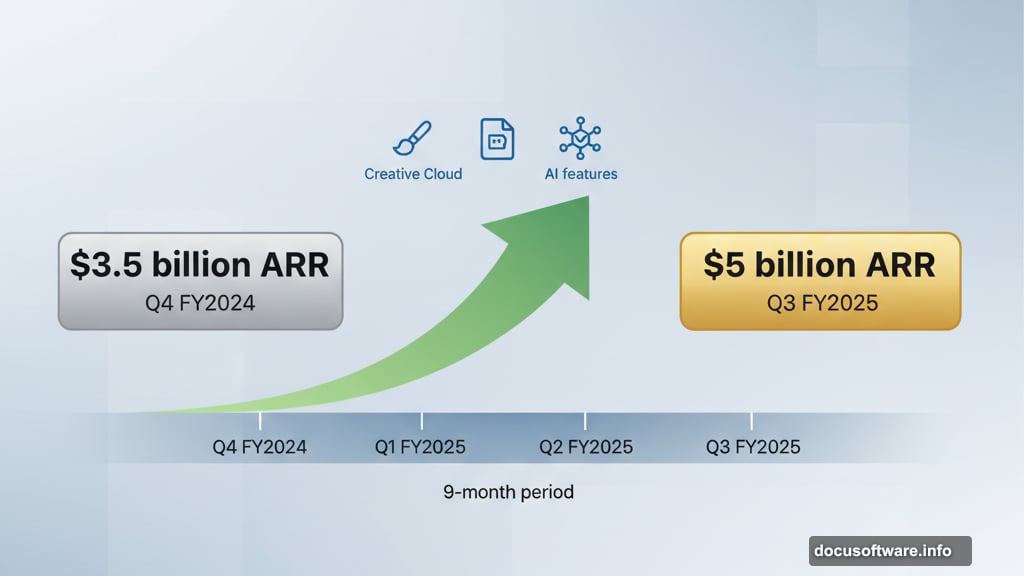

But here’s what really matters: Adobe’s AI business is exploding faster than anyone predicted. CEO Shantanu Narayen revealed that AI-influenced annual recurring revenue now exceeds $5 billion. That’s up from $3.5 billion just nine months ago at the end of fiscal 2024.

The AI Gold Rush Pays Off

Adobe bet big on artificial intelligence over the past two years. Now those bets are paying off in real dollars.

The company already surpassed its full-year target for AI-first ending ARR. Remember, we’re only in the third quarter. So Adobe achieved in nine months what they expected to take twelve.

What changed? Customers are actually using the AI features Adobe rolled out. Not just testing them. Not just kicking the tires. They’re paying for them month after month.

That matters because plenty of companies added “AI-powered” to their marketing without generating meaningful revenue. Adobe proved they can turn AI hype into subscription dollars.

Digital Media Crushes It

Adobe’s digital media business continues to dominate. The segment is on track for 11.3% annualized revenue growth for the full fiscal year. That’s better than the company’s earlier forecast of 11%.

Fourth quarter digital media revenue should land between $4.53 billion and $4.56 billion. Analysts expected $4.51 billion. So once again, Adobe is guiding above expectations.

Meanwhile, Creative Cloud and Document Cloud keep printing money. Designers, photographers, and creative professionals aren’t switching to alternatives. Instead, they’re upgrading to access new AI features that speed up their workflows.

This subscription model gives Adobe predictable, recurring revenue. Plus, once customers build their workflows around Adobe tools, switching costs become massive. That’s a competitive moat that keeps getting wider.

The Stock Finally Gets Its Day

Adobe’s stock jumped in extended trading after the results dropped. About time. Shares had plummeted 21% year-to-date through Thursday’s close while tech peers rallied.

The broader Nasdaq gained 14% this year. So Adobe badly underperformed even as it built out cutting-edge AI capabilities and maintained strong fundamentals.

Why the disconnect? Investors worried about competition from AI startups and open-source alternatives. They questioned whether Adobe could monetize AI fast enough. Those concerns now look overblown.

The market got this one wrong. Adobe proved they can integrate AI without cannibalizing existing revenue. Instead, AI features drive upgrades and attract new customers.

What Comes Next

Adobe’s fourth quarter guidance looks solid. The company expects adjusted earnings per share between $5.35 and $5.40, topping analyst estimates of $5.34.

Total revenue for Q4 should reach $6.08 billion to $6.13 billion. That matches analyst expectations at the midpoint but suggests continued momentum.

More importantly, Adobe’s AI business continues accelerating. The company isn’t guiding for AI revenue to plateau or slow down. Management sounds confident they can maintain this growth trajectory.

Creative professionals need Adobe’s tools to do their jobs. Now those tools are getting more powerful with AI assistance. So customers have reasons to pay more, not less.

The Real Story Behind These Numbers

Wall Street obsessed over whether Adobe could compete with AI-native startups. That was the wrong question.

Adobe already owns relationships with millions of creative professionals and businesses. They didn’t need to build from scratch. Instead, they integrated AI into tools customers already depend on daily.

That’s a massive advantage. Startups must convince users to abandon familiar workflows and learn new tools. Adobe just adds features to software people already use.

Plus, Adobe’s AI tools work across their entire suite. Generate an image in Firefly, edit it in Photoshop, incorporate it into a layout in InDesign. That integration creates value no single-purpose AI tool can match.

The company’s $5 billion in AI-influenced ARR proves this strategy works. Customers don’t want standalone AI tools. They want AI capabilities inside the applications they already use.

Adobe just showed everyone how to monetize AI: integrate it into products customers love rather than forcing them to switch to something new.