Adobe just dropped $1.9 billion on Semrush. That’s real money for what some dismissed as “just another SEO tool.”

But here’s what most coverage missed. This acquisition signals something bigger than two companies joining forces. It confirms what marketers feared all year: traditional search is dying, and AI platforms are eating everything.

Let’s talk about what this means for anyone trying to get found online.

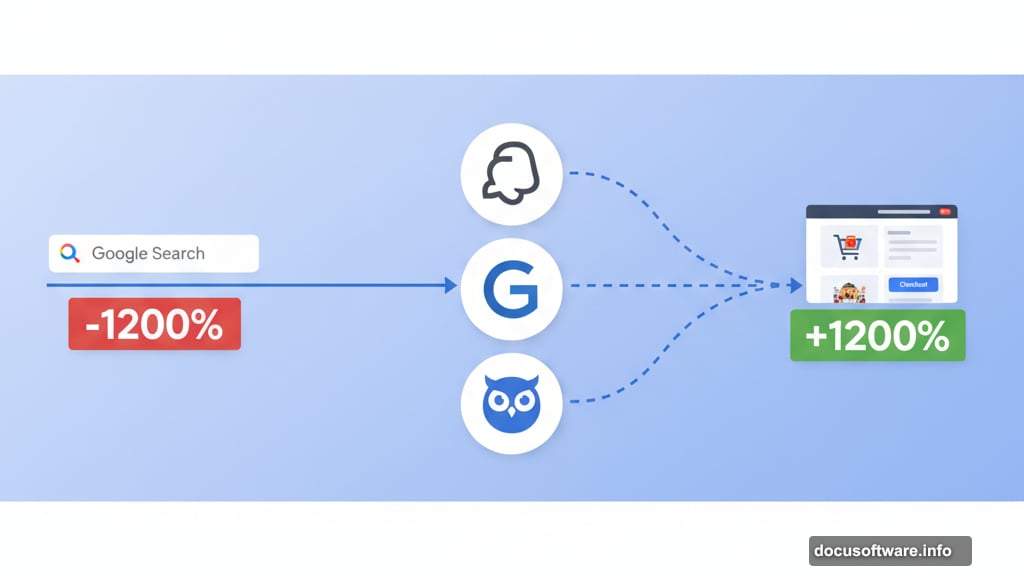

ChatGPT Traffic Exploded 1,200% This Year

Adobe Analytics tracked something wild in October 2025. Traffic from AI platforms to U.S. retail sites jumped 1,200% year-over-year.

Read that again. Not 120%. Not even 200%. A full 1,200% increase.

What does that mean? Consumers stopped Googling “best running shoes” and started asking ChatGPT, Gemini, or Perplexity instead. And these AI platforms synthesize answers from multiple sources, often without sending users to your website at all.

So your SEO strategy built around Google rankings? It’s becoming less relevant by the day. Plus, most marketing teams have no idea how to optimize content for AI platforms that don’t work like traditional search engines.

That’s the problem Adobe aims to solve with this acquisition.

Traditional SEO Skills Still Matter (But Not How You Think)

Here’s the twist nobody expected. AI platforms rely heavily on traditional search engine results for their source material.

ChatGPT doesn’t magically know everything. It pulls information from web content that ranks well in traditional search. So your existing SEO work still provides value. However, the end result looks completely different.

Instead of users clicking through to your site, AI platforms cite your content while keeping users inside their interface. You get attribution but lose the traffic. And without traffic, your conversion funnels collapse.

Moreover, AI platforms prioritize different signals than Google’s algorithm. They care less about backlinks and more about how clearly your content answers specific questions. That changes everything about content strategy.

Semrush Built Tools for This New Reality

Semrush developed something called generative engine optimization alongside traditional SEO capabilities. Sounds fancy. But what does it actually do?

The platform helps marketers understand how their brands appear across owned channels, large language models, traditional search engines, and the wider web. That’s a massive expansion from old-school keyword tracking and rank monitoring.

Take Amazon, JPMorganChase, or TikTok—all Semrush enterprise clients. These companies need to know when ChatGPT recommends their products or when Perplexity cites their research. Traditional analytics tools can’t track that. Semrush figured out how.

In fact, Semrush reported 33% year-over-year growth in enterprise annual recurring revenue. Big companies are paying serious money to solve brand visibility problems across AI platforms.

Adobe Bought What It Couldn’t Build Fast Enough

Adobe stock dropped over 20% in 2025. Investors worried whether the company could compete as an AI powerhouse against nimbler startups and tech giants expanding into marketing tools.

The Semrush acquisition answers that question. Instead of spending years developing generative engine optimization from scratch, Adobe wrote a check for $1.9 billion.

Compare that to Adobe’s failed $20 billion attempt to buy Figma in 2022. U.K. regulators killed that deal in December 2023, forcing Adobe to pay a $1 billion termination fee. This time, Adobe went smaller and smarter.

Plus, the strategic fit makes sense. Adobe already enables 99% of Fortune 100 companies to use AI for operations. Adding Semrush’s brand visibility tools fills a specific gap without triggering obvious antitrust concerns.

The $12 Per Share Price Tells a Story

Semrush closed at $6.76 on November 18, 2025. Adobe offered $12 per share the next day. That’s a 77% premium.

Why pay such a markup? Desperation disguised as strategic vision.

Adobe needed this capability immediately. Every month without generative engine optimization tools meant enterprise customers looking elsewhere. And once big clients switch marketing platforms, they rarely come back.

So Adobe overpaid by traditional valuation metrics. But in a market transforming this fast, speed matters more than price. Semrush gave Adobe instant credibility in a space where credibility determines survival.

Three Changes Hitting Your Marketing Stack Now

Ready for bad news? This acquisition won’t fix your problems. It just confirms you have them.

First, your content strategy needs a complete overhaul. Writing for Google’s algorithm is table stakes. Now you also need to optimize for how AI platforms synthesize and cite information. That means clearer answers, better source attribution, and structured data AI systems can easily parse.

Second, your analytics are lying to you. Traditional web analytics track visits and conversions. But they miss when AI platforms cite your brand without sending traffic. You’re getting exposure without measurable results. That makes proving marketing ROI nearly impossible with current tools.

Third, your SEO team needs new skills yesterday. The tactics that worked for the past decade—link building, keyword density,

Regulatory Approval Looks Likely (Unfortunately)

Adobe secured voting commitments from Semrush founders and stockholders representing over 75% of the company. That removes one major hurdle.

Regulatory approval seems probable too. Unlike the Figma deal, Adobe and Semrush don’t directly compete. One makes customer experience platforms. The other builds search optimization tools. Regulators typically allow vertical integrations that don’t eliminate competitors.

Both boards approved the transaction. Wachtell, Lipton, Rosen & Katz advises Adobe. Davis Polk & Wardwell counsels Semrush. These are serious law firms that don’t waste time on deals with obvious regulatory problems.

The companies expect to close during the first half of 2026. Absent some unexpected intervention, this deal goes through.

What This Means for Independent Marketers

Big companies can afford Semrush enterprise plans and Adobe’s premium tools. Small businesses and independent marketers? Not so much.

That’s the concerning part. As AI platforms reshape search, only large organizations will afford the tools needed to compete for visibility. The playing field tilts further toward enterprises with massive marketing budgets.

Plus, Adobe’s track record suggests price increases after acquisitions. Semrush might have offered affordable plans today. But once integrated into Adobe’s pricing structure, expect costs to rise significantly.

So independent marketers face a choice. Learn generative engine optimization through trial and error. Or watch larger competitors dominate AI-driven discovery channels while you scramble for scraps of traditional search traffic.

Traditional Search Isn’t Dead Yet (But It’s Dying)

Google still processes billions of queries daily. Bing remains relevant in enterprise contexts. Traditional search won’t disappear overnight.

However, the trajectory is clear. Younger consumers especially prefer asking AI for recommendations over scrolling through search results. And as AI platforms improve, this preference will spread across demographics.

McKinsey data showed $1.1 billion in equity investment flowing into agentic AI during 2024. Job postings related to this technology increased 985% from 2023 to 2024. That’s not a fad. That’s a fundamental shift in how humans access information.

Adobe’s $1.9 billion bet confirms what the data already showed. Brand visibility across AI platforms matters more than traditional search rankings. And companies that adapt win. Those that don’t become invisible.

The Uncomfortable Truth About AI-Mediated Commerce

Here’s what keeps me up at night. As AI agents handle more shopping and research tasks, traditional advertising models collapse.

Think about it. You can’t buy Google Ads that appear in ChatGPT’s responses. You can’t run display campaigns inside Perplexity’s interface. These platforms don’t monetize through advertising—at least not yet.

So how do brands compete for visibility? Through content quality, source authority, and the mysterious algorithms determining what AI platforms cite. That’s exponentially harder to game than traditional search engine optimization.

Moreover, AI platforms might start charging brands for preferential treatment eventually. Imagine paying ChatGPT to recommend your products more often. Or paying Perplexity for citation priority. That opens dystopian possibilities where money determines truth.

The Semrush acquisition gives Adobe tools to help brands navigate this transition. But nobody—including Adobe—knows exactly where this ends.

Choose your tools wisely. Invest in learning generative engine optimization before your competitors master it. And prepare for a world where AI platforms control access to consumers in ways we’re only beginning to understand.