AI chatbots are about to reshape how Americans shop online. And the numbers are wild.

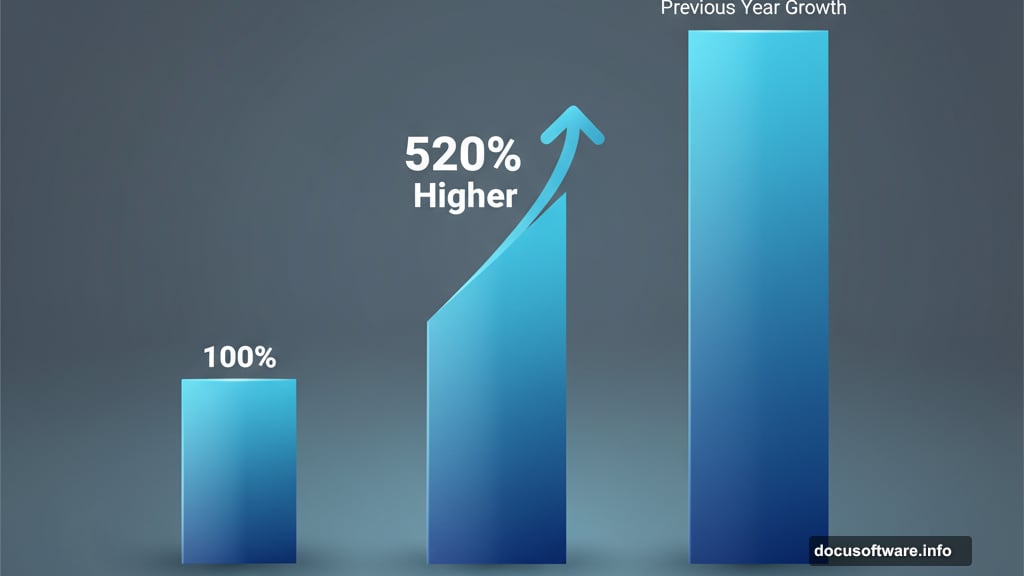

Adobe just dropped its annual holiday forecast, and one stat jumps out: AI-assisted shopping traffic will surge 520% year-over-year during the 2025 holiday season. That’s not a typo. We’re talking about a more than five-fold increase in shoppers using AI tools to find gifts, compare products, and hunt for deals.

This comes after AI shopping traffic already exploded 1,300% in 2024. So the trend isn’t slowing down. It’s accelerating fast.

What Adobe Actually Sees

Adobe Analytics tracks over 1 trillion visits to U.S. retail sites. Their software runs on most of the country’s top 100 online retailers. So when they make predictions, they’re not guessing. They’re watching real shopping behavior at massive scale.

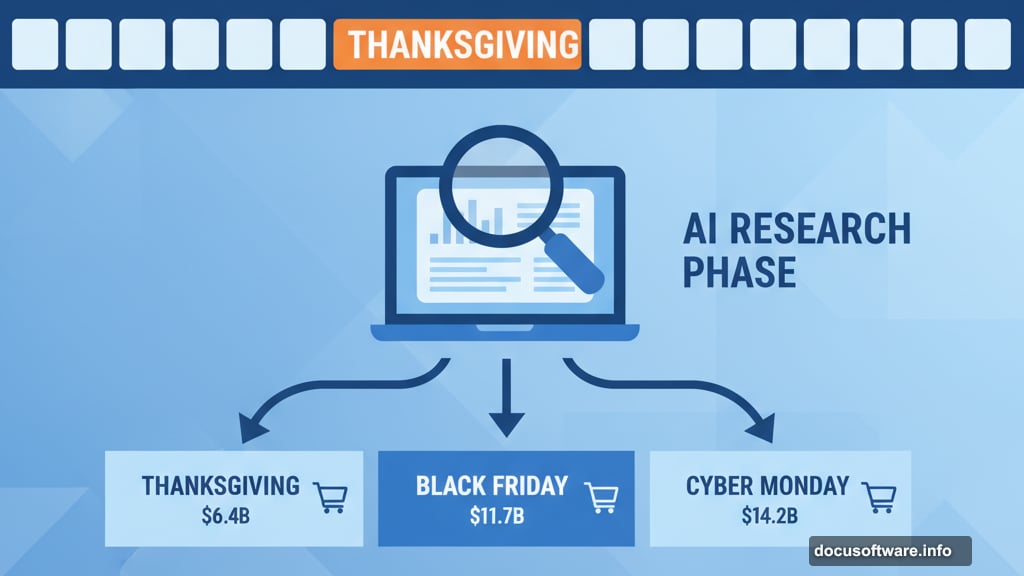

Their forecast calls for $253.4 billion in U.S. online holiday sales this year. That’s up 5.3% from 2024. Not earth-shattering growth, but solid and consistent.

Cyber Monday remains the biggest shopping day. Adobe expects $14.2 billion in sales, up 6.3% year-over-year. Black Friday will hit $11.7 billion, growing even faster at 8.3%. Plus, Thanksgiving Day itself will bring $6.4 billion in online spending.

But here’s what matters more than the total numbers: how people actually shop.

How Shoppers Use AI Tools

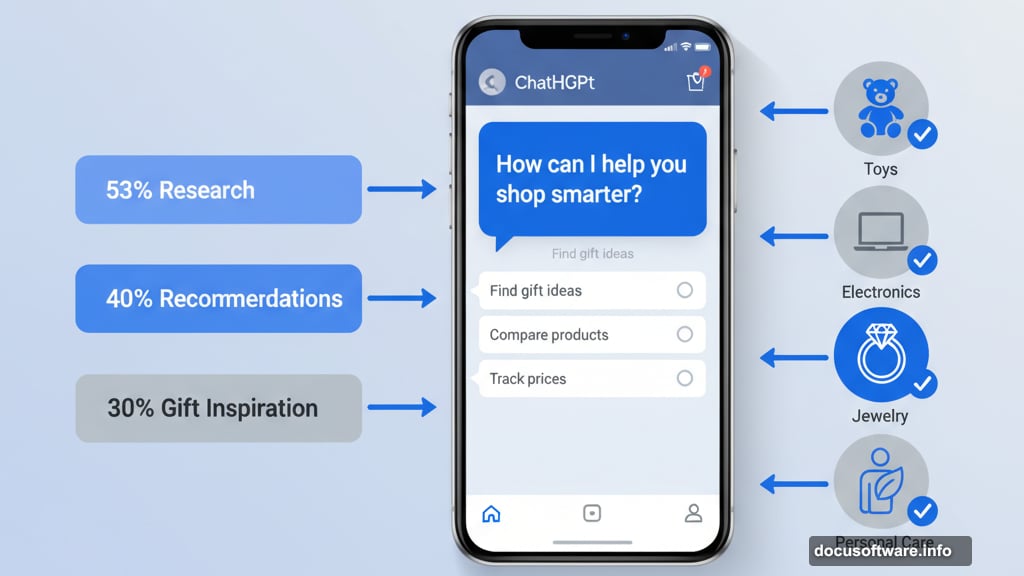

Adobe surveyed 5,000 U.S. consumers about their AI shopping habits. The results show clear patterns.

Most people use AI for research before buying. In fact, 53% said they might use AI services for this purpose. That makes sense. ChatGPT and similar tools excel at comparing features, summarizing reviews, and explaining technical specs.

Another 40% want AI recommendations. The old “customers who bought this also bought” algorithm just got way more sophisticated. Now AI can understand context, budget constraints, and specific needs in ways traditional recommendation engines never could.

Then 36% plan to use AI for deal hunting. Why manually check price history sites when AI can scan dozens of retailers instantly? And 30% want gift inspiration, where AI helps solve the eternal “what should I buy for Dad?” problem.

Adobe expects AI usage to peak across toys, electronics, jewelry, and personal care categories. Makes sense. Those categories involve lots of options, technical specifications, and personal preferences where AI guidance helps most.

The 10-Day Window Before Thanksgiving

AI shopping traffic will spike hardest in the 10 days leading up to Thanksgiving. That’s when shoppers seriously research big purchases before Black Friday and Cyber Monday deals drop.

Think about it. You don’t want to waste time on Black Friday morning comparing specs. You want to already know which TV, laptop, or kitchen appliance you’re buying. Then you just hunt for the best price when sales start.

So shoppers increasingly use AI in mid-November for research. Then they execute purchases during the big shopping days when discounts hit their peak.

This pattern differs from previous years when research happened gradually over weeks or months. Now it concentrates into a focused pre-Thanksgiving research sprint powered by AI tools.

Mobile Shopping Keeps Growing

Mobile devices will account for 56.1% of online holiday spending this year. That’s up from 54.5% in 2024 and 51.1% in 2023.

The trend shows no signs of stopping. Bigger smartphone screens make mobile shopping easier every year. Plus, most people already have their phones in hand constantly. So pulling up a retail app or website takes zero effort.

Yet each percentage point mobile gains represents billions in shifted spending. The entire retail experience continues optimizing for thumbs instead of mouse clicks.

Nobody knows when this mobile growth will flatten. Maybe when mobile hits 60% or 65% of online sales? Or maybe desktop shopping becomes a niche activity for specific high-consideration purchases?

Buy Now, Pay Later Crosses New Milestone

BNPL services will drive $20.2 billion in holiday spending. That’s up 11% year-over-year and about $2 billion more than 2024.

More importantly, Cyber Monday will see BNPL spend hit $1.04 billion for the first time. Crossing the billion-dollar mark for a single day shows how normalized these payment options have become.

Younger shoppers especially embrace BNPL. Splitting a $600 purchase into four $150 payments makes expensive items feel more accessible. Retailers know this and promote BNPL options aggressively at checkout.

Critics worry about consumer debt. Fair concern. But for now, BNPL keeps growing as retailers and payment providers push these services hard.

Social Commerce Finally Takes Off

Social media advertising will drive 51% year-over-year revenue growth for retailers. Compare that to just 5% growth in 2024.

What changed? TikTok Shop and Instagram Shopping matured significantly. Plus, retailers figured out how to actually convert social traffic into sales instead of just building brand awareness.

The seamless integration matters most. Shoppers can now complete purchases without leaving their social apps. That removes friction that previously killed conversion rates when users had to switch to external websites.

Younger consumers especially shop this way. For them, scrolling social media and discovering products blend into one activity. The shopping experience starts with an influencer post and ends with a completed purchase, all within the same app.

Discounts Drive Everything

Despite all the technology changes, old-fashioned discounts still matter most. Products will average 28% off list prices during the holiday season.

That discount level drives purchase decisions more than AI recommendations, mobile convenience, or BNPL options. Shoppers wait for deals. Then they pounce when prices drop.

Electronics ($57.5 billion, up 4% YoY), apparel ($47.6 billion, up 4.4% YoY), and furniture ($31.1 billion, up 6.5% YoY) remain the top spending categories. No surprises there. These categories always dominate holiday shopping.

But the 520% surge in AI shopping assistance will reshape how consumers research, compare, and ultimately choose products within those categories. The purchase volume might grow modestly, but the path to purchase transforms completely.

What This Means for Retailers

Retailers need to optimize for AI discovery right now. That means clean product data, detailed specifications, and accurate descriptions. When ChatGPT or Claude summarize your products, you want that information to be correct and compelling.

Many retailers still have messy product databases full of inconsistencies. That won’t cut it anymore. AI tools scrape and synthesize product information at scale. If your data is poor, AI will surface competitors with better information instead.

Mobile optimization remains critical too. A 56% mobile share means more than half your holiday revenue comes from small screens. Your checkout flow, product images, and site performance all need to work flawlessly on phones.

Plus, social commerce integration now matters for growth. That 51% year-over-year increase in social-driven revenue represents real money. Retailers ignoring TikTok Shop or Instagram Shopping leave sales on the table.

Finally, BNPL needs to be prominently displayed at checkout. Shoppers increasingly expect these options. Omitting them costs conversions, especially for purchases over $200.

The 2025 holiday season will be a testing ground for how AI, mobile, and social commerce converge. Retailers who adapt to these trends will capture growth. Those who don’t will watch competitors eat their lunch while wondering why their traditional strategies stopped working.